Introduction

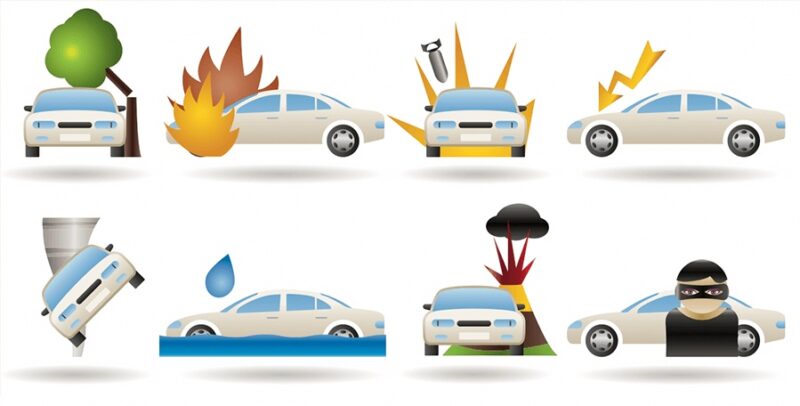

Comprehensive Auto Insurance: An auto insurance policy that covers damage caused to your vehicle as a result of events other than a collision is known as comprehensive insurance. If your car is involved in an accident with another car, is damaged by a tornado, is scratched by a deer or other creature, is spray-painted by a vandal or is damaged by vandalism, an earthquake, or a collapsing garage. If you are crushed by a car, among other events, comprehensive insurance will pay for it.

Definition of Comprehensive Auto Insurance

Comprehensive Auto Insurance is like a protective shield for your car that goes beyond just accidents. It covers a wide range of unexpected events, like theft, vandalism, damage to windscreens and glass, fire, animal accidents, weather, and other natural occurrences. So, while basic insurance takes care of collisions, comprehensive coverage steps in to handle those unexpected surprises life might throw at your car, helping you be more secure on the road.

Comprehensive Auto Insurance Covers What?

Every accident is different, and a variety of factors decide whether comprehensive insurance will cover yours. The following are some categories of harm that may fall under comprehensive auto insurance coverage:

- Theft

- Fire

- Vandalism

- Contact with animals

- Falling or flying objects

- Hail

- Windshield damage

- Windstorms

- Earthquakes

- Events outside your control:

Imagine a tree branch falling on your car during a storm, or someone damaging it in the parking lot. Comprehensive steps in to cover those repairs or even replace your car if it’s stolen.

- Nature’s fury:

Floods, hailstorms, wildfires – they all fall under the “comprehensive umbrella.” You won’t be left stranded with a hefty repair bill if Mother Nature throws a tantrum.

- Animal encounters:

Ever hit a deer on the road? Not fun, and repairs can be expensive. Comprehensive helps you out in such situations.

Is Comprehensive Auto Insurance Necessary?

Comprehensive Auto Insurance is not legally required, but it can be highly beneficial depending on your individual circumstances. Unlike liability insurance, which is typically mandatory, comprehensive auto insurance is optional.

Comprehensive coverage provides protection for damages to your vehicle that are not caused by a collision. This includes events such as theft, vandalism, natural disasters, or accidents involving animals. While it’s not a legal requirement, having comprehensive auto insurance can be valuable for those who want extra financial security and peace of mind in case unexpected events damage their car.

Ultimately, whether you need comprehensive auto insurance depends on your priorities, budget, and risk tolerance. If you want more extensive coverage beyond basic liability and are concerned about potential non-collision-related damages, then comprehensive insurance might be a wise choice. However, if you’re comfortable assuming some of those risks yourself, you may opt to forego comprehensive coverage. It’s always a good idea to assess your individual needs and consult with an insurance professional to determine the best coverage for your situation.

Comprehensive Auto Insurance Cost

“Comprehensive auto insurance cost” refers to the amount of money you need to pay for comprehensive coverage for your car. This type of insurance protects your vehicle from various non-collision-related incidents, like theft, vandalism, or natural disasters.

The cost of comprehensive auto insurance can vary based on several factors. Here are some key factors that influence the cost, along with a brief explanation:

- Deductible:

- Definition: The amount you pay out of pocket before your insurance coverage kicks in.

- Effect on Cost: A higher deductible usually means lower premiums but a higher initial cost if you make a claim.

- Coverage Limits:

- Definition: The maximum amount your insurance company will pay for a covered loss.

- Effect on Cost: Higher coverage limits typically result in higher premiums.

- Vehicle Value:

- Definition: The market value of your car.

- Effect on Cost: More expensive cars often have higher insurance costs.

- Location:

- Definition: Where you live and park your car.

- Effect on Cost: Urban areas or regions with higher crime rates may have higher insurance costs.

- Driving Record:

- Definition: Your history of accidents and traffic violations.

- Effect on Cost: A clean driving record usually leads to lower insurance costs.

- Credit History:

- Definition: Your credit score.

- Effect on Cost: Better credit may result in lower premiums.

Here’s a Simple Table Summarizing the Factors:

| Factors | Definition | Effect on Cost |

| Deductible | Amount paid before insurance kicks in | Higher deductible = Lower premiums, higher upfront cost |

| Coverage Limits | Maximum amount insurance will pay | Higher limits = Higher premiums |

| Vehicle Value | Market value of your car | More expensive cars = Higher insurance costs |

| Location | Where you live and park your car | Urban/high-crime areas = Higher insurance costs |

| Driving Record | History of accidents and violations | Clean record = Lower insurance costs |

| Credit History | Your credit score | Better credit = Lower premiums |

Remember, these are general guidelines, and actual costs can vary based on insurance providers and individual circumstances. It’s always a good idea to shop around and compare quotes to find the best comprehensive auto insurance cost for your specific needs.

Also Read This –

For all such news from the world, stay connected with us on latestbite.com Thanks.